Import classifications are the cornerstone of every shipment. Without a correct classification, you cannot determine duties or tariffs.

With trade compliance professionals wearing so many hats, classification is often an afterthought – just a number quickly slapped on the paperwork to get it off the dock. The result? Inconsistent and potentially incorrect classifications. Here are three common pitfalls we see in Harmonized Tariff Schedule (HTS) classification and how to remedy those to have a more accurate and complete process.

Pitfall 1: Forgetting the Basics

For many of us who have been doing this for years, classification becomes like a second nature. We review the product, look at the data sheets, and begin to determine where that item should go. We know (for example) that plastics are in Chapter 39, cables in 85, and valves are usually in Chapter 84. For the most part, we can look at our company’s items and bucket them fairly easily. While this lends itself to a quick classification, it can also get us into trouble. Sure we know the GRIs are there, but we don’t review them. We know how to find the Section Notes, but we often skip over them.

I’m an avid reader, but I often find myself skipping over the book’s introduction so I can get right to the good stuff. Usually, I end up having to go back because I’ve missed some crucial element that sets the plot for the book. Section and Chapter Notes are much like a preface of a book- they lay the foundation for your import classification giving important definitions, referrals to other chapters, and clarification on the parameters of that chapter. A common pitfall we see is classifiers who have forgotten the basics. They rush right to the chapter, skipping over the basics. Indentations and grammar are ignored or misread, leading to inaccurate classifications.

The section and chapter notes are an important element in a correct classification. Classifiers should be reviewing the section and chapter notes for important definitions, reviewing what is not covered in that chapter, and reviewing any provisions for parts located in the notes.

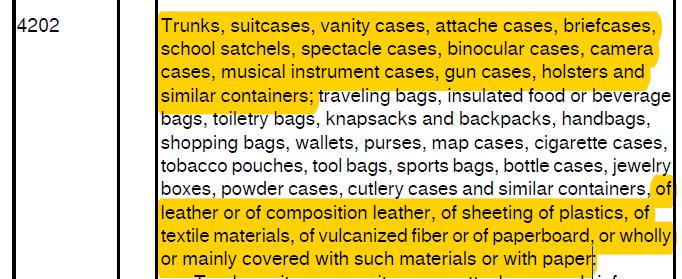

Another basic principle that is often overlooked is the importance of grammar in the HTS. Every comma, semi-colon or colon should be carefully reviewed. Missing one can result in a wrong classification. An example of this is in Chapter 42 of the HTS. Chapter 42 reads:

The semi-colon here is crucial. The items listed before that first semi-colon can be composed of any material, but the items following the semi-colon must be made of leather, composition leather, plastics, textile, vulcanized fiber or paperboard to be classified in this section. This detail is very easy to miss if you’re not paying attention to the punctuation. This is just one example, however, there are many entries where correctly reading the punctuation and indentation can make a difference in the classification. So, be sure to refer back to your high school grammar notes when classifying. (It’s ok- we won’t tell anyone you forgot what a semi-colon was.)

Pitfall 2: Not Using Tools Available

Long gone are the days of that huge metal HTS binder sitting on your desk and flipping through page by page. Classifiers not only have access to the most up-to-date online tariff schedule for free, but to many other resources as well. These resources can make determining the correct HTS classification so much easier and less time consuming. Here is a list of resources we typically use:

- CROSS Customs Rulings Website

- Informed Compliance Publications

- HTS Index

- WCO Explanatory Notes (must be purchased)

- Manufacturer/supplier websites

The Cross Customs Rulings website provides a link into binding rulings for thousands of products. Using the correct combination of words, parentheses, and information will typically lend itself to a binding ruling for a similar product. You can search by tariff number, single words (ex. cable) or multiple words (ex. cable assembly), exact phrases using double quotes (“cable assembly”), and also by using the words “and”, “not”, and “or” (ex. cable and NOT connectors) to arrive at the results you are looking for. The rulings will also provide insights into why something was classified a certain way.

Informed Compliance Publications provide additional guidance on distinguishing between bolts and screws, classifying items in 8411, classifying sets, ball bearings, valuation and many other topics. In addition to these websites, using the HTS index, Explanatory Notes, and manufacturer’s websites are all great resources to assist classifiers in determining where their product falls in the HTS.

Pitfall 3: Stopping before completing a rationale

So you’ve scanned the GRIs, read the section notes, followed the grammar, used the resources and you have come up with a classification you are sure is correct. Slap that baby on the paperwork and you’re done! Right? WRONG! One of the biggest pitfalls we see in classification is stopping once you’ve found that magical, 10-digit number. No HTS classification is complete without a good rationale to back it up. Let’s face it, we all think our memories are way better than they actually are. It only takes missing one really important meeting or birthday to prove us wrong. You may have spent hours on a classification, reviewing every detail and you are sure you will never forget that one, but lo and behold, years later when someone asks how you got to that decision, you’ll find yourself not remembering what you thought you would. The rationale is critical should your classification ever come under scrutiny.

A rationale should include the following elements:

– A brief description of the part

– Where the information was obtained (name of engineer, datasheet, etc.)

– Why you chose that classification

– Any explanatory notes, section notes, chapter notes, binding rulings used in your decision

– Applicable General Rule of Interpretation

– Explanation of the thought process you used when determining the HTS

A good rationale doesn’t always have to be long or take you an hour to write. Depending on the classification it could range from something really short like “Per Joe Engineer on May 10, 2018, this is a stainless steel helical spring washer. GRI (1)” to something more in-depth for those harder classifications. Your rationale is complete if someone is able to ‘reverse engineer’ it and turn it into a classification. In other words, you should be able to determine the classification based solely on reading the rationale. It should paint a clear picture to show the who, what, where, how and why of that import classification.

Determining an HTS is made up of many different elements. We hope that knowing these pitfalls will help you on your way to more accurate classifications.

If you need additional resources or help with your product classifications, please contact Export Solutions for a free consultation.

Emmalie Armstrong is a Trade Compliance Consultant with Export Solutions – a firm specializing in U.S. import/export regulations.