In The Matrix, a computer hacker named Neo takes a red pill that unlocks a hidden world – one where he has tremendous superpowers and vision into the true nature of reality.

In trade compliance, unfortunately, there are no magic red pills.

But if you want to get down to the truth, there is a code to be cracked. Specifically, the HTS code for your product.

What is an HTS code?

HTS codes, or Harmonized Tariff Schedule codes, are vital tools in the the world trade and of international trade. They are derived from the Harmonized Schedule (HS), which is developed by the World Customs Organization (WCO) and used in most countries to classify goods.

The HS code is a standardized system for classifying imported and exported goods. It is a six-digit code, the first two of first six digits represent the Chapter, then the middle two are the Heading, and the final two are the Subheading.

These codes are nearly universal; however, classification can vary from country to country and classification requires a detailed knowledge of the goods in question. It’s important to remember that HTS codes are critical for trade compliance, and there are several common HTS classification mistakes that you should keep an eye out for.

From electronics to textiles, these codes are indispensable in navigating the complexities of global commerce.

In the United States, we use the Harmonized Tariff Schedule of the United States (HTSUS) and classify imported and exported products according to the Harmonized Tariff Schedule (HTS codes). The HTS code is a ten-digit code.

The first six digits are identical to the HS code, the two subsequent digits 7th and 8th provide the U.S. subheading and duty rate, and the last four digits and two are statistical suffixes.

In the most part of this article, we’ll dive deeper into the origin, purpose, implications of incorrect codes, and provide a step-by-step process to identify them accurately, aiding businesses in their trade endeavors.

Where did they come from? The origin of HTS codes.

“They came from outer space!” Although HTS codes can seem otherworldly, the HTSUS actually came from Congress. In 1989, to be exact. (The same year that brought us Nintendo’s Game Boy and Koosh Balls.)

Congress replaced the previous Tariff Schedule of the United States, to bring standardization to internationally traded goods.

HTS codes are established and maintained by the United States International Trade Commission (USITC), and originate from the international harmonized system published by the WCO.

While the USITC is responsible for maintaining and publishing the HTSUS, United States Customs and Border Protection (CBP) is responsible for interpreting the document and enforcing it.

What’s the purpose of an HTS code?

HTS codes play a crucial role in classifying goods for customs purposes, aiding in import classification, and determining customs duties.

They facilitate international trade by providing a standardized system for categorization and statistical analysis of goods, ensuring smooth transactions and compliance with regulatory requirements.

The implication of recent changes to HTS codes

There were 11 revisions to the HTSUS in 2023 alone. Each revision provides an opportunity for HTS codes to change, which can impact duty and tariff rates for items.

Additionally, the WCO will periodically review and update the Harmonized System, which results in changes to the entire HTSUS and often create entirely new categories which may change the whole classification system of goods.

For example, in the latest HS update adopted into the HTSUS in 2022, an entirely new category for 3D printers was the last two digits being added, which shifted their classification from heading 8479 to 8485.

Importers must stay informed about these revisions to ensure compliance and may need to review their classification process to ensure they are providing the correct codes.

How can incorrect HTS codes affect your business?

Incorrect HTS classification and product classification codes and codes pose significant risks to businesses. CBP has the right to ask for more information about and reclassify imported goods until the entry they came in on is liquidated, a process that takes around three years.

This can significantly increase the landed cost of those goods years after they’ve been imported.

Here’s one example. Export Solutions recently helped a client who received a CF28 Request for Information and CF29 Notice of Action. These actions administered by the u.s CBP would have resulted in a duty rate that was about 2.5 times the rate the product had been originally entered under.

After researching and classifying the product, our team determined it was classified differently than CBP’s proposed classification. The correct classification resulted in only a small increase in duty – saving the client potentially thousands of dollars in duties for future imports.

Incorrect classifications can also result in increased import holds on cargo, delaying the import process, which also may incur expensive exam fees, as well as CBP audits of past entries.

Customs authorities can also impose penalties and fines for incorrect classification beyond simple increases to duty rates.

Step-By-Step: How to find your HTS code

Before you can figure out how to identify the correct HTS code for your product, you must understand how the HTSUS works. The most up-to-date version of the HTSUS can be found on the official USITC website.

The HTSUS encompasses 22 sections and 99 chapters, classifying an array of goods.

Each section and chapter are accompanied by Chapter and Section Notes, which is legal text that specifies additional information about what is to be or cannot be in classify products classified within them.

There are three chapters within the HTSUS which are not like the rest: Chapter 77 is currently unused and designated for future use, and Chapter 98 and 99 are reserved for trade remedies and are typically where additional tariffs or exceptions to duty rates for certain products can be found.

(To put this another way, your product is most likely not in one of these chapters, which leaves only 96 chapters to go! Happy reading.)

Additionally, HTS incorporates General Rules of Interpretation (GRIs), General Notes, General Statistical Notes, and other guidelines featuring additional descriptions and clarifications essential for classifying goods and comprehending tariff rates.

Understanding the GRIs, and General, Section, Chapter, Subheading, and Statistical Notes can be challenging. Fear not! Export Solutions can help you with your classification questions and provide you with peace of mind while importing goods.

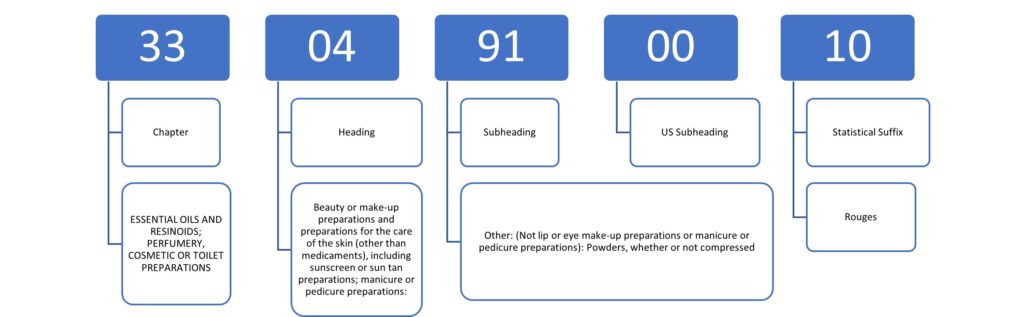

As mentioned before, HTS codes are 10-digit codes. Classification is the process of finding the correct 10-digit number for your product using hs codes.

Let’s go step-by-step to classify an example. How about powder blush imported from South Korea? Sound good? Here we go:

Step 1: Find the right chapter

First, we need to find the correct Chapter for powder blush.

Blush is a type of cosmetic. Starting in the table of contents for the HTSUS, we find that Chapter 33 covers “Essential oils and resinoids; perfumery, cosmetic, or toilet preparations” so we will most likely find the correct HTS code in Chapter 33.

Please note that GRI 1 means that chapter and section titles are provided for ease of reference, so they are not legally binding like the headings are, but it’s okay to use them to narrow down your search.

Step 2: Get our heading

Like a ship lost at sea, we’ll never get to port without the right heading.

Our next step is to find the Heading that describes powder blush. You should read through the Headings until finding the one that best describes the product.

While blush is again, not specifically described, we find that Heading 3304 describes: “Beauty or make-up preparations and preparations for the care of the skin (other than medicaments), including sunscreen or suntan preparations; manicure or pedicure preparations.”

It looks like this:

So, we can conclude that “blush” belongs under Heading 3304 as a make-up preparation.

While blush is a relatively simple product to find the heading for, some products may be described by more than one heading.

You should always check the Chapter and Section Notes for exclusions and definitions. This is where really understanding those GRIs comes in handy.

Step 3: Go to the Subheading

We’re getting closer. Next, we need to find the Subheading and/or U.S. Subheading.

Again, we need to read through the next indented subheading’s descriptive text. Blush is not lip or eye make-up, nor is it a preparation for manicures or pedicures, so it is going to fall under a residual or basket category of “other” that includes every product not specified in previous subheadings.

When comparing subheadings, you need to compare all at the first level of indentation, then at the second, and so on. We find under the “other” subheading 3304.91.00 that describes “Powders, whether or not compressed.”

This 8-digit HTS code provides our duty rate (in this case, the product is “free” or a 0% duty rate).

Step 4: The final digits

The last step is to find the first hs full, 10-digit HTS code, which includes the Statistical Suffix. In this case, that is 3304.91.0010: “Rouges” as rouge is another word for blush.

The full 10-digit HTS code to classify powder blush is 3304.91.0010. (You may notice that periods are added in the HTS code.

These just exist to make the code easier to read by breaking it up visually.) Here’s the breakdown:

Useful resources to help find the right HTS code

If you’re unsure how to classify your product, seek guidance from an expert. Export Solutions has decades of experience classifying products in all different chapters of the HTS.

We can also do the legwork and research of GRIs and past rulings to make sure your product is correctly classified, without overpaying (or underpaying) duty.

Some other resources and ideas include:

The HTSUS can be found and searched online at Harmonized Tariff Schedule (usitc.gov)

You can also search Customs Ruling Online Search System (CROSS) for a database of previous CBP rulings, using search terms to find your product.

You can request a binding ruling request from CBP by following the requirements here.

Our team is here to help you with HTS codes

Understanding and accurately determining your HTS code is crucial for smooth international trade. If you need assistance, reach out to Export Solutions.

Our experts will review your classifications at no cost, ensuring you’re on the right track and providing guidance on the best ways to achieve compliance.

Kali Kaufman is a Classification Specialist for Export Solutions -- a full-service consulting firm specializing in U.S. import and export regulations.