When it comes to importing, accuracy in your import entry is not only important, but also essential. One of the most critical components of this process is the proper classification of goods under the Harmonized Tariff Schedule (HTS).

At first glance, this might seem like a simple task. Depending on the product, it can be—but as many seasoned importers know, classification can quickly become complex.

A quote from Plato captures this challenge well:

“Things are not always what they seem; the first appearance deceives many.”

Why Correct Classification Matters

Getting the classification right is vital because it directly determines the amount of duty assessed at the time of import.

Beyond just duties, HTS classifications affect whether a Free Trade Agreement (FTA) applies, whether additional tariffs (such as Section 301 or Section 232) are in play, and whether the product is subject to anti-dumping (AD) or countervailing duties (CVD).

Classification also determines whether other government agencies (OGAs)—such as the FDA, ATF, USDA, EPA, or DOT—must review or clear the shipment. An incorrect classification could result in delays, penalties, or even seizure of goods.

Consequences of Misclassification

Incorrect classification can result in both overpayment and underpayment of duties. If U.S. Customs and Border Protection (CBP) identifies an issue, they will typically issue a Request for Information (CF-28) to gather details. If they determine that the classification was incorrect, a Notice of Action (CF-29) will follow, outlining their position and any changes to the duty owed.

In practice, reclassification often results in the importer owing additional duty to CBP. Refunds are less common but possible if the reclassification is in the importer’s favor.

Tools for Accurate Classification

Accurate classification isn’t guesswork—it’s a process supported by several important resources. Here are key tools and references you should be using:

- Harmonized Tariff Schedule (HTSUS): This is your primary reference for all tariff numbers. Read both the Section Notes and Chapter Notes carefully, as they can exclude or clarify classification eligibility.

- Explanatory Notes (ENs): Published by the World Customs Organization, these provide detailed explanations of HTS headings. Access typically requires a subscription or purchase.

- Customs Rulings Online Search System (CROSS): An essential database of binding rulings, protests, and classification decisions by CBP. Reviewing similar product rulings can provide clarity and precedent.

- Court Decisions: In cases of ambiguity or dispute, reviewing legal decisions on classification may help support a ruling request or protest.

- Informed Compliance Publications and Webinars: CBP offers a wide range of educational resources, including free webinars and compliance guidance, to assist importers with correct classification.

- General Rules of Interpretation (GRI): Found at the front of the HTSUS, these rules govern how goods should be classified. They must be followed in order—GRI 1 comes before GRI 2, and so on. Skipping rules to find a favorable classification is not permitted.

Example: Artificial Christmas Trees

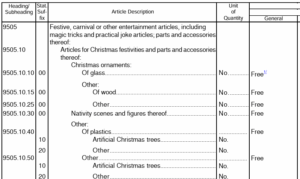

Consider artificial Christmas trees. On the surface, this might seem straightforward—after all, there’s a specific HTS number for them. However, classification can be deceptive.

A search of CROSS reveals 395 rulings on “artificial Christmas trees.” While HTS subheadings like 9505.10.40 or 9505.10.50 once seemed appropriate, more recent rulings and court decisions have reclassified these trees under 9505.10.2500, provided they are not made of glass or wood.

This reclassification reflects CBP’s interpretation of case law, and it serves as a prime example of how HTS classification is not always intuitive.

Final Thoughts

This is just one example—many classifications are far more complex. You might find yourself feeling a bit like Alice falling deeper down the rabbit hole. But despite the challenge, accurate classification is crucial. It affects compliance, cost, and supply chain efficiency.

In today’s dynamic trade environment, precision matters more than ever. (And yes, correct Country of Origin declarations matter just as much—but that’s a topic for another blog.)

If you’d like a second set of eyes on your classifications, schedule a no-charge consultation with one of our experts today. We’re here to help you navigate this essential aspect of global trade with confidence.

Shawna Karajic is a Senior Consultant for Export Solutions -- a full-service consulting firm specializing in U.S. import and export regulations.