If you ever received a refund from CBP, you would typically receive a paper check mailed to you. But get ready, changes are coming and very soon. No longer will you see that check from the US Department of Treasury, refunds will be issued electronically. The interim final rule goes into effect on February 6, 2026 and public comment for this rule must be received by March 3, 2026.

Last March, President Trump issued Executive Order 14247, Modernizing Payments To and From America’s Bank Account. This EO spells out the intent to stop issuing paper checks for any disbursements and the goal is to help curb financial fraud and improper payments. Not only does this extend to CBP refunds, but any disbursement that is made to a company or individual from America’s bank account.

What does this mean for you?

Starting on February 6, 2026 CBP will issue ALL refunds electronically. This includes importers, brokers, filers, sureties, service providers, facility operators, foreign trade zone operators, carriers and any designated third party listed on CBP form 4811.

If you are currently enrolled in the ACH Refund program, then you don’t have to do anything, and it will continue without interruption. However, if you are NOT enrolled, then you better get moving to make sure you get set up for the ACH Refund program. CBP won’t issue any paper checks after February 6, unless a waiver has been approved.

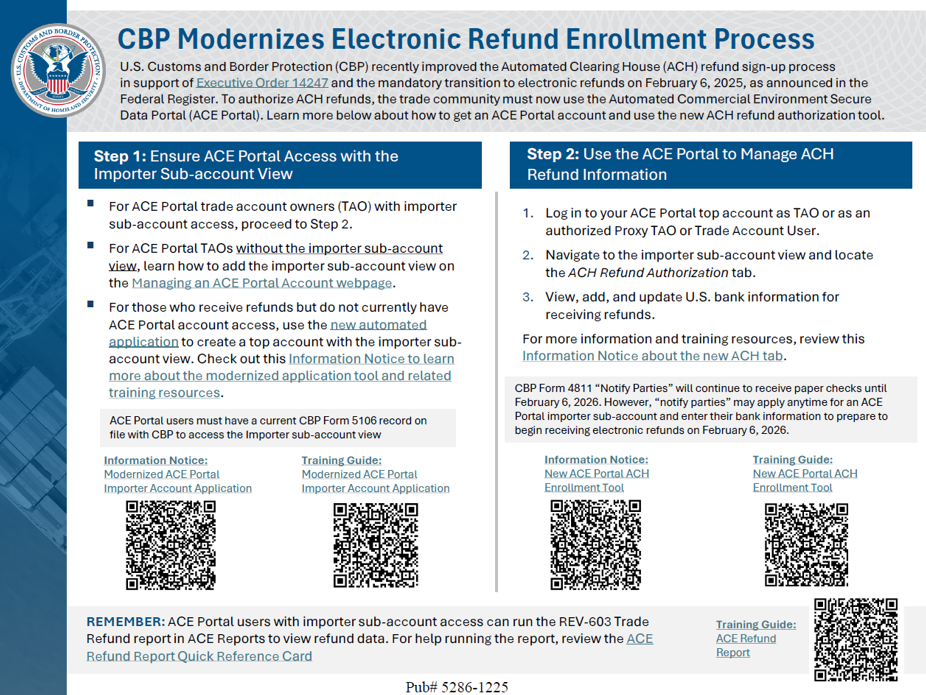

How do you register for the ACH Refund Program?

First, you must submit an application for an ACE Portal account if an account doesn’t exist. Once the account is set up, the account owner must complete the ACH Refund application in the ACE Portal. You will find this under the ACH Refund Authorization tab. Here you will provide CBP with the designated banking information that is consistent with 31 U.S.C. 3332(g). The account owner can authorize access to other pertinent trade users under this tab as well. If you have a third party designated to receive the refunds per the CBP form 4811, the third-party designee must also have an ACE Portal account and complete the ACH Refund application.

For the ACH Refund application, all applicants must use a U.S. bank account and provide the relevant account information.

If a CBP form 4811 is already on file with CBP prior to the effective date, then the third-party designation will remain valid. The designee MUST complete the ACH refund application in order to receive the electronic refunds. If they do not, then the refund will default to the importer’s ACH account. It is the importer’s responsibility to ensure the accuracy of the third-party designation and to contact CBP if any information needs to be updated or if the third-party designation needs to be revoked.

What are the benefits?

There are several benefits to transitioning away from the paper check. The main one is that you will receive the refund quicker. Your check won’t “get lost” in the mail and have to wait for a check to be reissued.

Another benefit is that you will have an ACE Portal account. There are many importers or exporters that don’t have access to ACE. CBP has made great strides in what ACE can do. For importers, you will be able to see any CF28s or 29s that get issued and you can reply to them within the ACE portal. You can also file protests within ACE (this might come in handy pending the outcome of the Supreme Court decision on the IEEPA tariffs). For both importers and exporters, you can run different reports to access a variety of data related to your international trade activities.

CBP provided the sheet below in their CSMS message that was issued on January 2. This is a great breakdown of the steps that importers need to take to get set up for their electronic refunds.

Make sure you take the necessary steps now to ensure that you get your ACH Refund Authorization account set up as soon as possible. February 6 will come sooner than you think, and you don’t want to be left out in the cold waiting for a paper check that is never going to arrive.

If you have questions regarding this or any other import/export questions that pertain to your business, we invite you to schedule a no-charge consultation with one of our trade compliance experts.

Shawna Karajic is a Senior Consultant for Export Solutions -- a full-service consulting firm specializing in U.S. import and export regulations.