The clock is ticking! Exporters have just one month (until November 15, 2016) to change the language and use of their Destination Control Statements (DCS). As the U.S. Government moves forward with the harmonization of export regulations under Export Control Reform, the ITAR and the EAR will soon be aligned with respect to the content and use of the DCS.

Gone will be the days of having one DCS for EAR-controlled items, a separate DCS for ITAR-controlled items, and a third DCS for shipments containing both types of items. Now, companies will use the following DCS on all exports:

“These items are controlled by the U.S. Government and authorized for export only to the country of ultimate destination for use by the ultimate consignee or end-user(s) herein identified. They may not be resold, transferred, or otherwise disposed of, to any other country or to any person other than the authorized ultimate consignee or end-user(s), either in their original form or after being incorporated into other items, without first obtaining approval from the U.S. Government or as otherwise authorized by U.S. law and regulations.”

The requirements for when and where the new DCS must appear have also changed. For both the ITAR and the EAR, the new DCS is required to appear only on the Commercial Invoice for all exports. Previously, it was also required to appear on other export documentations, such as the air waybill, bill of lading or other shipping documents. Additionally:

ITAR – 22 C.F.R. § 123.9 will require that:

- The DCS must appear on the Commercial Invoice for exports, re-exports and retransfers of all ITAR-controlled tangible items.

- The Commercial Invoice must also specify: (1) the country of ultimate destination; (2) the end-user’s name; and (3) the license or approval number or applicable license exception.

- If the shipment includes an item subject to the EAR, the exporter must also provide the end-user with the item’s Export Control Classification Number (ECCN).

EAR – 15 C.F.R. § 758.6 will require that:

- The DCS is required only on shipments of tangible items subject to the EAR, including exports authorized under NLR (No License Required).

- A DCS is not required for exports of EAR99 items or items exported under License Exception BAG or GFT.

- For shipments of 9×515 or “600 series” items exported in tangible form, the ECCN of each item must be included on the Commercial Invoice.

- For intangible exports, BIS does not require, but instead recommends as a good compliance measure, the inclusion of a DCS on any commercial invoice, all ECCNs and other relevant export control information.

Remember, these changes are effective November 15, 2016. That means exporters should now begin to make the necessary updates to their internal processes (including electronic systems for generating Commercial Invoices, etc.), to ensure that the new DCS language appears on their Commercial Invoices by the deadline.

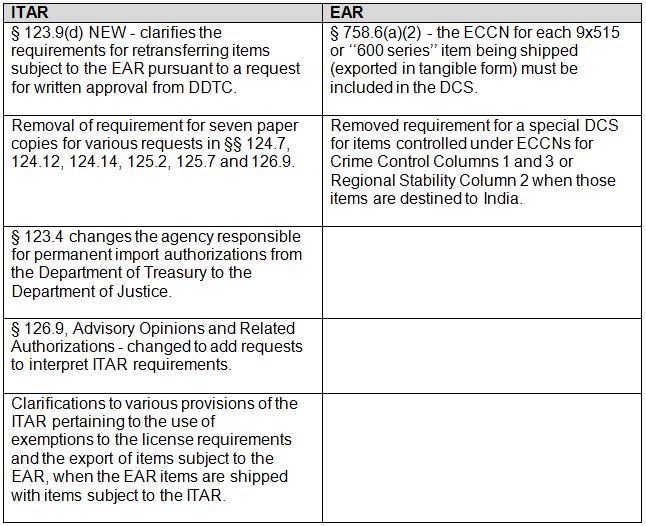

There were other minor changes included in the Federal Register Notices implementing the harmonization of the Destination Control Statement. Below is a table summarizing these changes:

Jim McShane is a Sr. Consultant, Trade Compliance for Export Solutions -- a full-service consulting firm specializing in ITAR and EAR regulations.